Thursday, April 9, 2015

Thursday, April 9, 2015 7 Examples Of How Context Matters For Mutual Fund, ETF Marketers

Advertising,

Advertising,  Analytics,

Analytics,  CRM,

CRM,  Content,

Content,  Email,

Email,  Financial Advisors,

Financial Advisors,  Mobile,

Mobile,  Social Media Comments Off

Tweet

Social Media Comments Off

Tweet

You can’t control the U.S. mail. If your large cap growth promotion happens to arrive at a financial advisor’s office on a day when the stock market is tanking, well, that’s how it is. Shake it off—you didn’t know, how could you? Looks like that piece is not going to work as well as you’d hoped.

And, that pretty much sums up the powerlessness of a direct mail marketer. Moving on…

Communicating online is less forgiving. Digital marketers are assumed to have control of their online communications including not just the What but the When and even the Where and the How.

Communicating online is less forgiving. Digital marketers are assumed to have control of their online communications including not just the What but the When and even the Where and the How.

Add to this mix the fact that financial advisors are not just reachable online but also more knowable online. This heightens expectations that communications are relevant and appropriate.

The context of what's being communicated is an increasingly important factor to consider in the planning and execution of mutual fund and exchange-traded fund (ETF) marketing.

“Context” is a concept that’s open for interpretation, and I’ll admit to taking some liberties below. But let’s start out right, with a definition, courtesy of an ebook from StrongView, Context Changes Everything.

StrongView explains context “as a combination of the consumer’s [client’s] disposition and situation, coupled with the business’s disposition and situation.”

Disposition refers to the essence of who a consumer is and includes demographic and behavioral data. Situation refers to dimensions that are constantly changing—location, social setting, sentiment and needs, for example.

“The relevance of a firm’s interactions is related directly to its understanding of customer context,” StrongView writes.

One of my favorite non-asset management examples: Do you remember when NetFlix accidentally released Season 3 of House of Cards in mid-February? Boston residents thought that was by design, as a consolation as Boston braced for another blizzard. Think of the goodwill engendered if that had been the intention.

If you don't already, I’d encourage you and your team to begin to pay attention to context. Who knows how the Apple Watch is going to rock content marketers’ world, starting with tomorrow's pre-orders. But it seems a safe guess that “wearable” content delivery will make context-awareness even more important.

To urge you along, I offer the following list of how context can make a difference. It’s in no particular order and in a slightly different tone. I’ve let myself go snarkier than usual to make obvious to you the need for alertness on the part of marketers, supported by enabling technology including customer relationship management (CRM) systems, marketing automation and Web, email and social analytics. Opportunities abound for relevant communicators. This is a partial, random list—surely, you can think of more?

What Not To Do

1. Overestimate The Compelling Value Of That PDF

Send a blast email with a link to a PDF at a time of day when you'd reasonably expect most recipients to be checking their email on smartphones. Do you communicate across multiple time zones? Right, well, you could stagger the email sends by location, drawing on regional information no doubt extractable from your CRM. It is more work. How important are those PDF opens to you?

1A. Burn Through Your New List

Use your hard-fought-for list of conference emails to email attendees while the conference is underway. Please don't. They won’t read your introductory message then, and all you've done is waste an opportunity. Conference attendees are battling to stay on top of their business emails, yours will be one they’ll be happy to quickly dispose of. Choose your time and message wisely.

Use your hard-fought-for list of conference emails to email attendees while the conference is underway. Please don't. They won’t read your introductory message then, and all you've done is waste an opportunity. Conference attendees are battling to stay on top of their business emails, yours will be one they’ll be happy to quickly dispose of. Choose your time and message wisely.

2. Play Hide-And-Seek With People Who Are Already Stressed

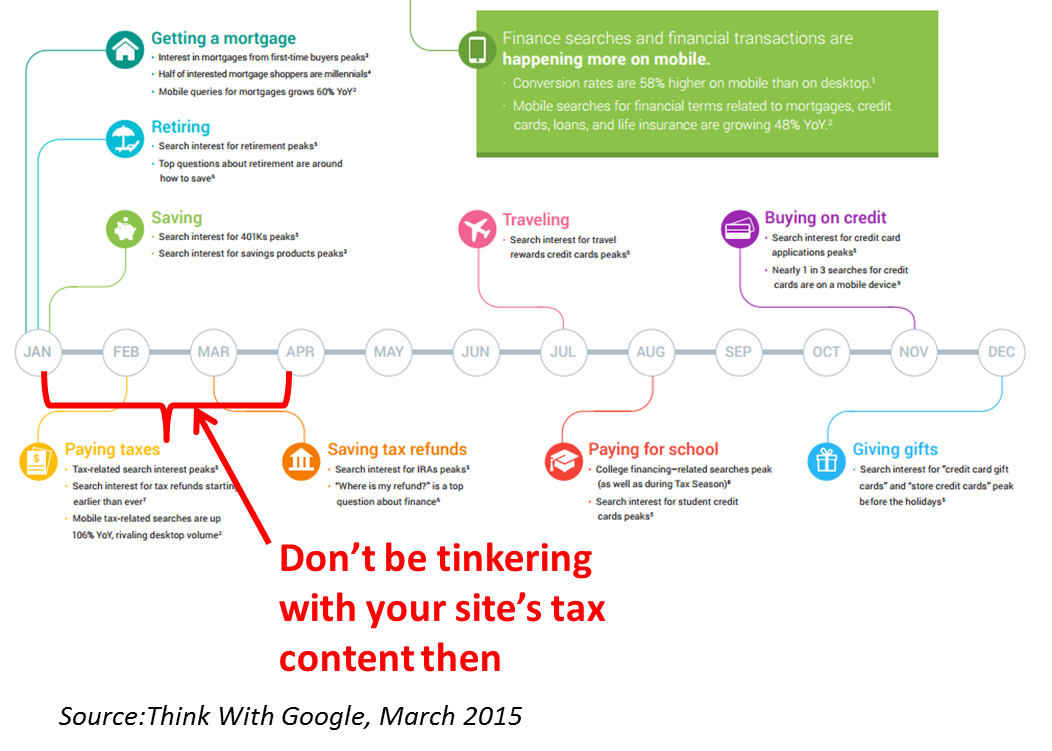

Move your tax-related content from one place on the Website to another in the months between January and April. Oh, and don’t sweat the details about trying to map redirects to every single (likely Google-indexed) page. Are you trying to incur the wrath of your clients and the people who answer the phone lines at your firm?

The graphic below is excerpted from a Google Finance Trends infographic (link opens a PDF) that reports that tax-related searches are starting earlier in the year, and that more are happening on mobile devices. Plan your enhancements for during the off-season.

3. Dawdle With The News

3. Dawdle With The News

Twitter is all about what’s happening now or maybe in the last 24 hours. A February tweet announcing the availability of your 12/31 communications is going to impress no one. That’s not what Twitter is for, I wouldn’t bother.

Did you see the number of firms that jumped on the Lipper award announcements last week? InvestmentNews published this list immediately after the evening ceremony March 31 and quite a few firms took to Twitter the very next day. Looks like Thornburg needed a full day but imagine how that ginormous image looked in a tweet stream.

That’s the way to do it. If your announcement is still working its way through your process, I’d say that ship has sailed on Twitter—the news was so last week. (Your timely addressing of bad news would be expected, too, but let's save that for another list, another day.)

Off-topic but I also really like TIAA-CREF’s use of its Twitter header image to promote its Lipper dominance. Where is it written that asset managers need to use a moody photograph of their headquarters as their Twitter image and never ever change it?

4. Advertise 24/7 If You Can Help It

Pay for broad match AdWords searches all day and all night. Unless you are convinced that financial advisors are looking for solutions in the wee hours, I have one word for you: dayparting. Let the non-advisor (most likely) night owls amuse themselves with organic search results or run up some other firm's pay-per-click budget.

5. Get Caught Sleeping At The Wheel

Release a blog post on your firm’s philanthropy (or whatever) on the day the Fed raises interest rates for the first time in seven years. Throw your body in front of this if you have to.

If you’re not fortunate enough to have a blog contributor offering a reaction post that day, don’t publish anything. It’s better to say nothing than to reach your blog subscribers—on a day when they’ll be paying extra attention to what you contact them about—with something that suggests that your team is either on autopilot or blissfully unaware.

6. Just Stroll In There Like It's 1999

Fail to train your wholesalers how to check for LinkedIn profiles and updates (including links to blog posts), tweets and Facebook updates prior to calling on advisors. Advisors research their clients (and vendors) and you can be certain that they expect others to be doing the same due diligence on them. I may have mentioned this before.

7. Lump Everybody Together

7. Lump Everybody Together

Track and report on your Web visitors as one homogenous group, as if desktop, table and mobile sessions all yield the same experience. As if all visitors regardless of device have the same motivations or needs.

If you were to segment the traffic, you would see some eye-opening differences.

Note: Blane Warrene, co-founder of Arkovi Social Media Archiving, now financial technology speaker and advisor and editor at large of TheDigitalFA, and I discussed the state of asset manager marketing on Blane’s Digital Well podcast last week. Blane is fun to talk to and it’s a freewheeling discussion (what was supposed to be 30 minutes turned into 40). If you check it out, here’s hoping there will be something in it for you.

Note: Blane Warrene, co-founder of Arkovi Social Media Archiving, now financial technology speaker and advisor and editor at large of TheDigitalFA, and I discussed the state of asset manager marketing on Blane’s Digital Well podcast last week. Blane is fun to talk to and it’s a freewheeling discussion (what was supposed to be 30 minutes turned into 40). If you check it out, here’s hoping there will be something in it for you.