Wednesday, October 19, 2011

Wednesday, October 19, 2011 U.S. Asset Managers Not Part Of Global Slowdown In Financial Services Tweeting

"90% of Twitter accounts in financial services are inactive"

Whoa. I read a Visible Banking blog post with that headline yesterday and then tweeted it. But I couldn’t shake the thought—seriously, all this work to get Twitter accounts up and running and then you’re going to let the opportunity go stagnant by not tweeting in a month or more? That was a dreary thought on what was already a dreary October day in Chicago.

But, no, I'm happy to say that’s not the case with the much smaller set of U.S.-based investment managers we track. The 90% figure comes from Christophe Langlois who has taken on the massive task of studying the social media activities of financial services companies including 1,500 bank, insurance company and asset manager Twitter accounts in 72 countries.

It would seem that it's the rest of them who are the slackers—you "early-adopting" U.S. investment companies are getting it done, according to the data I’m looking at. (And that's about as far as I'm going to press any U.S. superiority, by the way. Many U.S. asset managers have global parents. Also, just 50 asset managers active on Twitter by the third quarter of 2011? We can do better.)

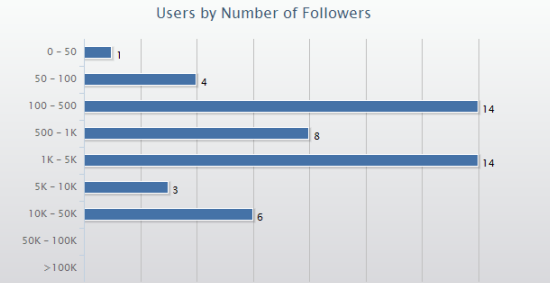

The following graphs are an analysis of the 50 members of the Rock The Boat Marketing Investment Manager Twitter list, as made possible by an application called SocialBro. You can do your own analysis using this public list as well as any additional filtering you might want to apply. I do wish the graphs had headings and were better labeled.

90% Of U.S. Investment Managers Have Tweeted Within The Last Month

I ran this data Tuesday night, and two-thirds of mutual fund and exchange-traded fund (ETF) companies had tweeted within the last 24 hours. Good for you.

Mutual Fund/ETF Firms Tend To Tweet Light…

Granted, the asset managers’ Twitter accounts are not super-chatty. This chart requires some study. I think it means that most firms are sending more than one tweet per week. Beyond that, there might be some double counting.

…Which Contains Their Follower Count…

...And Many Just Can’t Or Won’t Make Friends

To have a friend, in Twitter parlance, is to be following an account that follows you. Some firms’ Compliance functions won’t allow a Twitter account to follow. As can be seen in the look below at the six investment managers with at least 10,000 followers—@PIMCO, @Vanguard_Group, @iSharesETFs, @USAA, @Fidelity and @TheHartford—only @PIMCO can get by without following anyone.

Reactions? Thoughts? All are welcome below. Also, if you know of a U.S.-based investment manager that belongs on the Twitter list, please let me know.

Reader Comments (3)

Thanks for sharing this data, Pat! I'm surprised to see such a low number of active twitter-ers! Good for those ahead of the pack!

More are on the way, Jinn. As you all deal with daily at AdvisorWebsites, the wheels of progress can grind slowly when communications are regulated. Thanks for stopping by.

[...] U.S. Asset Managers Not Part of Global Slowdown in Financial Services Tweeting (Pat Allen). According to Christophe Langlois, a whopping 90% of global twitter accounts in financial services are inactive . Find out how the US fares vis a vis its international counterparts, and then recap the 7 ways you can optimize your existing twitter account. [...]